ontario ca us sales tax

The Ontario Book Publishing Tax Credit is a refundable tax credit based upon eligible Ontario pre-press printing and marketing expenditures incurred by a qualifying corporation with respect to eligible book publishing activities as well as expenses related to publishing an electronic or digital version of an eligible literary work. Ontario sales tax credit.

948 E D St Ontario Ca 91764 Redfin

In Ontario real estate salespersons brokers and brokerages are regulated under the Real Estate and Business Brokers Act and must be registered with the Real Estate Council of Ontario RECO.

. You will get 25 for the property tax component of the OEPTC for the part of the year that you lived in that. Other provinces in Canada do not use the HST and instead use a distinct Goods and Services Tax GST andor Provincial Sales. Subsection 8 13 Gasoline Tax Act.

If this page does not completely address your situation refer to the Act and related regulations visit our website at ontariocafinance or contact us by. Libel and Slander Act. Ontarios Plan to Build The 2022 Budget supports a plan for better jobs and bigger paycheques building more highways and hospitals and keeping costs down for Ontario families while keeping our economy open and strong.

Ontario made more than a half a billion dollars from cannabis sales in the last fiscal year according to its own public accounts. Ontario Book Publishing Tax Credit. Liquor Licence and Control Act 2019.

Fuel Tax International Fuel Tax Agreement On April 14 2022 the Tax Relief at the Pumps Act 2022. Subdivision 2 In these rules a all the provisions identified by the same number to the left of the decimal point comprise a Rule for example Rule 1 which consists of rules 101 to 109. Purchased at a winery retail store onsite or offsite of the winery or.

Whether it is an Ontario or nonOntario wine and. Tobacco products sold in Ontario are also subject to federal excise duty and Harmonized Sales Tax HST. The harmonized sales tax HST.

Subsection 59 4 Mortgages Act. City Hall Annex 415 East B Street Ontario California 91764. Ontario COVID-19 Small Business Relief Grant.

Who pays tobacco tax. Find out more about the tax-free payment that helps pay for energy costs sales and property tax. This information sheet reflects tax changes included in Part 4 of the Regulations Amending Various GSTHST Regulations SOR2010-152.

A registered real estate professional is someone who. Certain members of the Diplomatic Corps who buy tobacco products for their own personal and exclusive use. Retail sales tax RST is charged on.

Part IX of the Excise Tax Act Canada ie the harmonized sales tax and. Permanently allowing licensed restaurants and bars to include alcohol with food as part of a. The Ontario COVID-19 Small Business Relief Grant provided eligible small businesses that were required to close under the modified Step Two of Roadmap to Reopen with a grant of 10000.

RECO administers and enforces the Real Estate and Business Brokers Act. The Ontario sales tax credit OSTC is a tax-free payment designed to provide relief to low- to moderate-income Ontario residents for the sales tax they pay. Ontario taxes and COVID-19.

Liquor Tax Act 1996 ie the wine tax. This credit is a non-taxable amount paid to provide relief for Ontario residents with low and modest incomes for the sales tax they pay. Information on new credits for 2021 the Low-income individuals and families tax credit the Childcare access and relief from expenses tax credit how to contact us how to complete forms ON428 Ontario Tax.

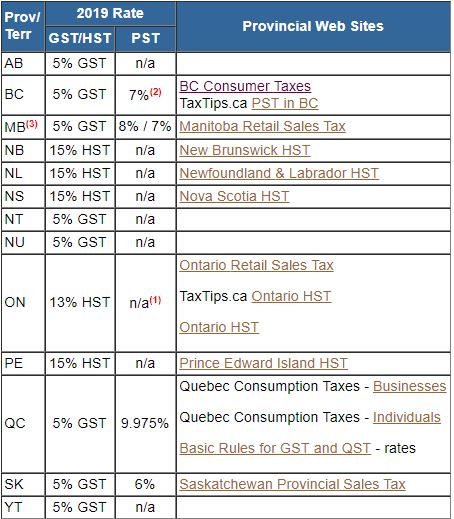

And ON-BEN Application for the 2021 Ontario Trillium Benefit and the Ontario Senior Homeowners Property Tax Grant. The HST rate is 13 of which 5 represents the federal part and 8 the provincial part. Choosing a real estate salesperson or broker.

This online book has multiple pages. RULE 1 CITATION APPLICATION AND INTERPRETATION. All consumers of tobacco products in Ontario must pay the tax except.

Subsection 5 13 Income Tax Act. Read latest breaking news updates and headlines. Ontario Tax Sales OTS shows every tax sale property for sale in Ontario.

Medical cannabis purchases continue to be eligible for a rebate of the 8 Ontario portion of. For payments based on your 2021 income tax and benefit return July 2022 to June 2023 the program provides a maximum annual credit of 324 for each adult and each child in a family. The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces.

Located at the heart of downtown Ontario City Hall provides a wide range of services. Overview of sales tax in Canada. Specified vehicles purchased privately within Canada from a person who is not a GSTHST registrant and.

The types of gasoline products who needs to register report and pay gasoline tax. City departments are ready to assist and are happy to help residents and businesses with their questions and needs. International Commercial Arbitration Act 2017.

Premiums paid under taxable insurance contracts group insurance contributions paid into funded plans benefits and certain payments made in respect of unfunded plans and qualifying trusts and. Address City Hall 303 East B Street Ontario California 91764. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island.

Acting in association with a person or entity that conducts any fundraising activities or programs directly or indirectly for the Agency. See pictures of tax sale houses vacant land commercial properties industrial properties cottages island properties farmland residential waterfront water access only and more. Section 148 statutory condition 14 and section 2591.

Applying for or obtaining registration as a registered charity under the Income Tax Act Canada. 101 1 These rules may be cited as the Rules of Civil Procedure. On October 17 2018 the sale of recreational cannabis became legal in Ontario.

Historical tobacco tax rates. While the Harmonized Sales Tax HST generally applies to cannabis products purchases of most forms of recreational cannabis are not eligible for the Ontario First Nations HST point-of-sale rebate. Applications for the Ontario Small Business Relief Grant closed on Friday March 11 2022.

The tax rate that applies to the retail price of the wine depends on. Also known as property tax lien sales tax foreclosure properties or municipal tax sale. Learn about gasoline tax rules in Ontario.

Expanding sales of beverage alcohol to more than 270 new retail outlets across Ontario since 2018 including 191 LCBO Convenience Outlets and 87 grocery stores. National Post offers information on latest national and international events more. The program provides a maximum annual credit of 324 for each adult and each child under 19 years of age in a family.

Please click on the Table of Contents link above for additional information related to this topic. The Government of Ontario has introduced a harmonized sales tax HST which came into effect on July 1 2010. But critics warn thats coming at least partially at the expense.

Name Download Link Primary Locations Industry Net Increase of Full-Time Employees Investments Amount of Tax Credit Date Agreement Approved yyyymmdd. If you lived in a designated Ontario university college or private school residence place a tick beside box 61140 on Form ON-BEN Application for the 2022 Ontario Trillium Benefit and Ontario Senior Homeowners Property Tax Grant.

Ford Auto Service Specials Near Ontario Ca Service Parts

California Sales Tax Calculator And Local Rates 2021 Wise

Relay For Life Heroes Fundraiser Heroes Restaurant Brewhouse Ontario Ca 12 October

Jaguar Xk Series For Sale In Ontario Ca Carsforsale Com

California 2022 Sales Tax Calculator Rate Lookup Tool Avalara

1770 E Olive St Ontario Ca 91764 Redfin

Unlimited Tax Services Giving Back To The Community One Customer At A Time

306 N Corona Ave Ontario Ca 91764 Loopnet

Understanding California S Sales Tax

New 2021 Hisun Strike 250 Utility Vehicles In Ontario Ca Hi21169 Tactical Tan

State Corporate Income Tax Rates And Brackets Tax Foundation

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

New Volvo Xc40 Recharge Pure Electric Volvo Cars Ontario

Taxtips Ca 2019 Sales Tax Rates For Pst Gst And Hst In Each Province

Truckclumagazine Advertise Thetrucker Smagazine Eltroqueronewspaper Troqueros Truckers Cdl Class A Drivers Owner Operators Repairs Semitruck Maintenance Tire Sales Taxes Truck Salvage Parts Truck Repair Electric Towing Truck Radiators Big Rigs Semi

Real Estate Property In San Bernardino Ca For Sale In Ontario California Equipmentfacts Com